how to lower property taxes in ohio

While you cant do anything about the tax rates of. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

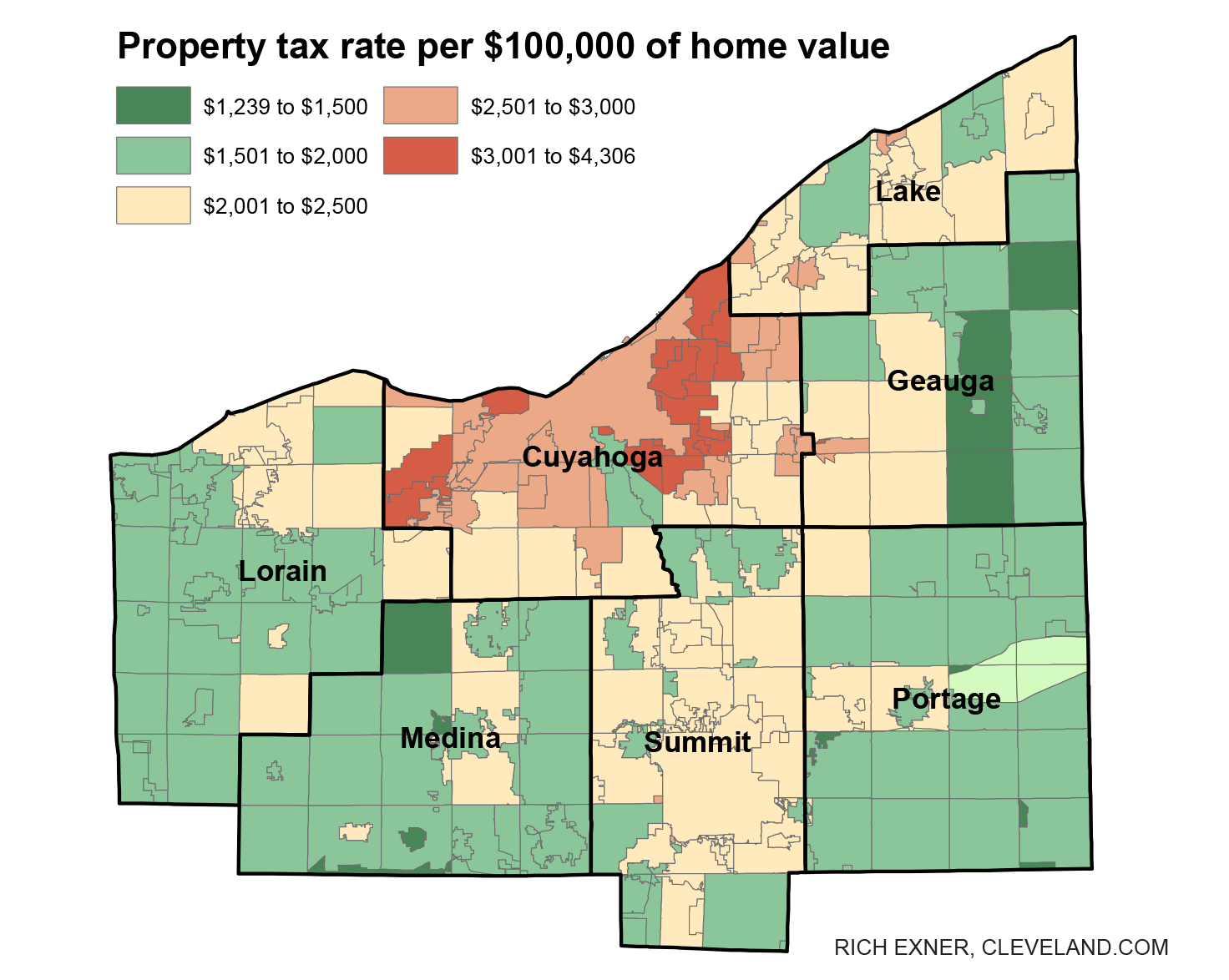

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

The exemption offers homeowners who are disabled or over 65 years old a reduction of.

. Find the Most Recent Comps. The exact time frame to begin filing appeals varies but all counties in Ohio must accept appeals through March for the tax bills due that. Lets start with the good news.

School districts generally receive between 65 percent to 70 percent of property taxes collected meaning that they are the government entity most affected. Your state may also offer a tax relief program for low-income individuals. If you are under 65 and disabled you also have to download Form.

When people get their annual notice of assessment in the mail thats when they typically get fired up about lowering their property taxes. This is awarded as a rebate or tax credit that is intended to cover a portion of your property tax bill. What Can You Do To Lower Your Property Tax in Ohio.

Visit the Ohio Department of Taxation website and download Form DTE 105A. While the recession knocked most property values down to early 2000s levels most of the country has recovered and home values have increased each year. Up to 25 cash back Method 2.

When you complete certain home improvement projects like boosting curb appeal adding a pool or revamping a kitchen the value of your home is sure to rise. How to Lower Your Property Taxes. The exact property tax levied depends on the county in Ohio the property is located in.

Wide range of floor coverings to view in our store. You cant make any deductions and since you cant dispute the Town Tax Rate the only way to lower your property tax rate is. School districts generally receive between 65 percent to 70 percent of property taxes collected meaning.

If that disabled person qualified for the homestead exemption he or she could. Limit Home Improvement Projects. Its calculated at 50 percent of your homes appraised value meaning youre only.

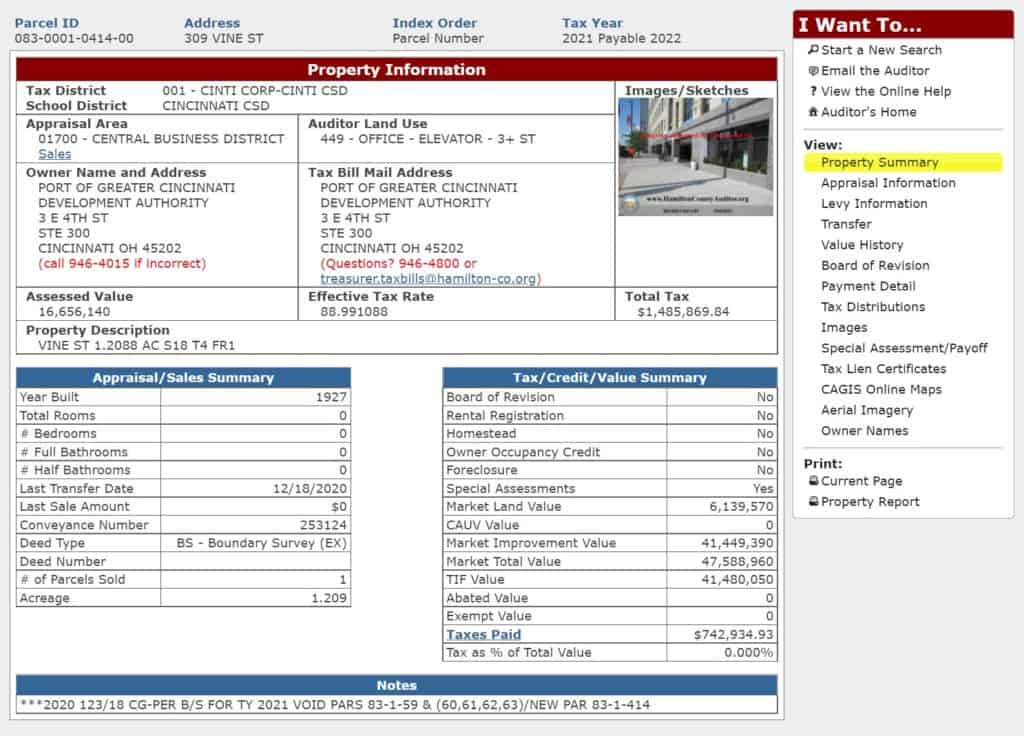

You can find this on the Hamilton County Auditor. Mortgage Relief Program is Giving 3708 Back to Homeowners. Since 1971 a 10 percent reduction or rollback has ap plied to each taxpayers real property tax bill.

The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes. File Your Property Tax Appeal. The assessed value of your homeproperty and the actual tax rates applied.

In addition to trying to reduce the taxable value of your home Ohio property tax law allows for reduced property taxes if you meet certain requirements. 01988 402000 07766 951372. For example consider a disabled person with a 75000 home.

Get Ready to Wait. Your house has most likely increased in value over the last couple of years. For example through the homestead exemption a home with a market value of 100000 is billed as if it is worth 75000.

Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it. Below is a summary of the most common such programs in Ohio. Find All Tax Breaks to Which Youre Entitled.

In order to lower your current property tax first evaluate your current property record card This is the official description of your house. How to Lower Your Property Taxes in Ohio. As detailed by the Ohio Department of Taxation the homestead exemption allows qualifying individuals to remove a maximum of 25000 from the market value of their property in the form of a tax credit.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Check Your Eligibility Today. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of median home value per year.

A constitutional amendment allowing senior citizens to pay lower property taxes in Ohio was approved by voters in 1970. How much you receive depends on your income and your property assessment. First if the owner is seeking a decrease in property value of more than 50000 the BOR will notify the local school district.

There are two parts to your tax bill. First if the owner is seeking a decrease in property value of more than 50000 the BOR will notify the local school district. So if your property is assessed at 300000 and.

This means two things. DoNotPay is your expert advisor on both courses of action and we can provide you with customized actionable advice that could make a significant difference to your property tax bill. If the school district decides to become involved with the owners case its counsel is allowed to.

Property tax rollbacks. Claim the homestead exemption if you are eligible. New Yorks senior exemption is also pretty generous.

Since an increase in your homes value will lead to a rise in property taxes it makes sense to limit home improvement projects. If you want to reduce your property tax liability in Ohio you have to address either the tax rate or the assessed property value of your home. Enroll in a Tax Relief Program.

Later that year in 2007 it became apparent that General Assembly expansion wouldnt only apply to senior citizens regardless of their incomes. Gregory Erich Phillips Oct 17 2017. Look at Your Annual Notice of Assessment.

Last year the Ohio General Assembly made changes to the Homestead Exemption which provides for annual property tax relief to Eligible Homeowners all homeowners 65 and older and all totally and permanently disabled homeownersIn the past many homeowners were deemed ineligible for the Homestead Exemption due to annual income thresholds but under. In 2005 as part of a broader series of tax reforms the General Assembly lim ited the 10 percent rollback to all real property not intended primarily for use in a business activity.

Real Property Tax Homestead Means Testing Department Of Taxation

How To Approach Pandemic Relief For Ohio Real Property Taxes Tucker Ellis Llp

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

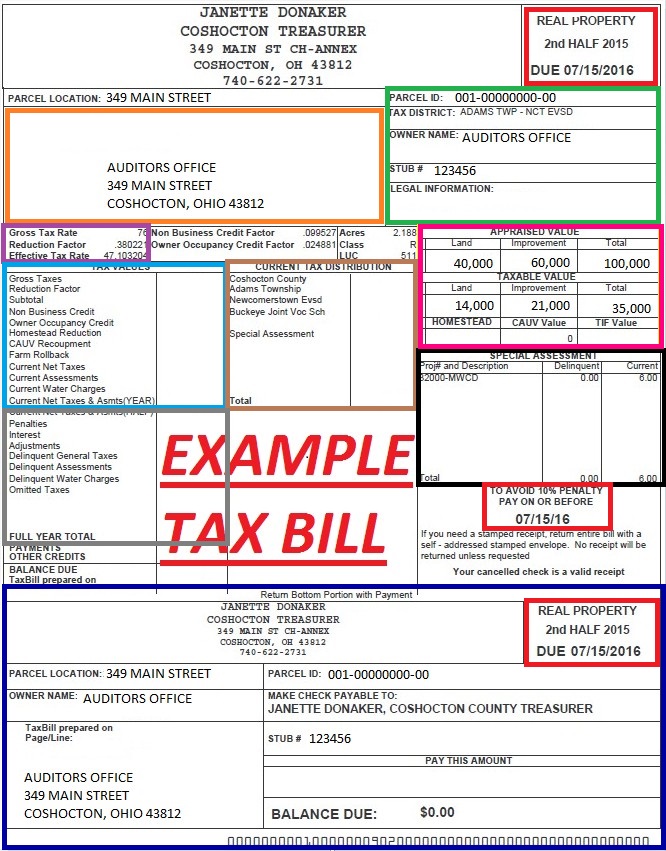

Understanding Your Tax Bill Coshocton County Auditor

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Distributions Real Property Tax Rollbacks Overview Department Of Taxation

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Brecksville Finance Property Taxes

Can You Still Deduct Ohio Income Taxes From Your Federal Taxes

Pay Property Taxes Online County Of Columbiana Papergov

Ohio Tax Rates Things To Know Credit Karma

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Find Tax Help Cuyahoga County Department Of Consumer Affairs

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates